IRA & BIL Implementation Resource Library

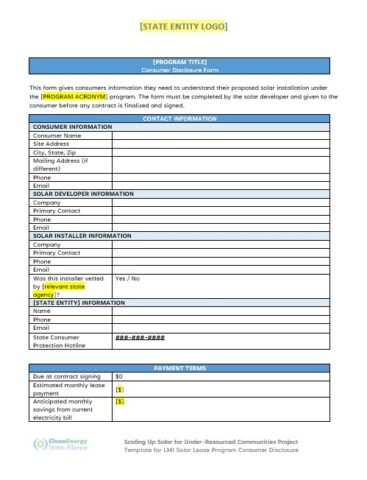

This Low- and Moderate-Income (LMI) solar lease template consumer disclosure form offers an example that states and other stakeholders can use to ensure that LMI customers participating in state programs designed to broaden solar access receive the information they need to understand their solar contracts. This template is meant to be used as a starting point for states building solar lease (or PPA) programs.

This guide offers simple options for states to add Multifamily Affordable Housing (MFAH) solar and/or solar+storage to their application to the $7 billion Greenhouse Gas Reduction Fund (GGRF) Solar for All competition (Solar for All) and take advantage of the new tax credit features of the Inflation reduction Act.

This document offers insights into how states can design and launch community solar programs that benefit disadvantaged communities and low- and moderate-income households using the $7 billion Greenhouse Gas Reduction Fund Solar for All competition and take advantage of new tax credits features available under the Inflation Reduction Act.

To facilitate the design and launch of LMI single-family homes program by states and to leverage existing funding opportunities from the IRA, CESA produced a template RFP to select on or more solar developers to deliver a solar program to disadvantaged communities and low-income households.

To facilitate the design and launch of LMI solar programs by states and to leverage existing funding opportunities from the IRA, CESA produced this guidance note along with a standard RFP that can be used by states and other relevant stakeholders to design and launch Greenhouse Gas Reduction Fund-compliant LMI programs in their state.

CESA submitted comments to the EPA regarding the Greenhouse Gas Reduction Fund Implementation Framework, authorized under the IRA. The comments chiefly pertain to the Solar for All Competition but also relate to some of the requirements set under the GGRF Framework applicable to all three competitions.

Energy modeling—using computer software and mathematical equations to simulate the operation and growth of energy systems—can be a powerful tool for state decarbonization planning. But because modeling can be costly and the results can be prone to misinterpretation, models need to be used carefully.

CESA submitted a response to a RFI from the US DOE about two programs authorized by the IRA — Home Efficiency Rebates and Home Electrification Rebates.

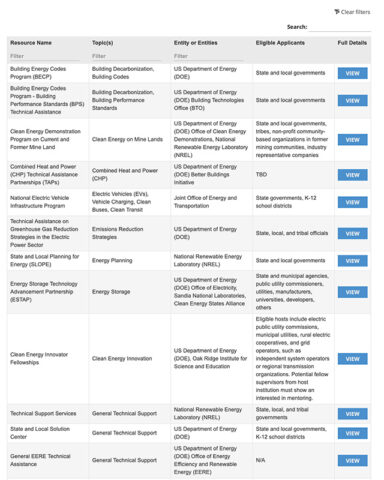

CESA has compiled a searchable list of clean energy technical assistance opportunities available to states. The list is available as an interactive table or downloadable excel document, and it will be regularly updated when new opportunities become available to states.

- « Previous

- 1

- 2

- 3

- Next »

Low-Income Communities Bonus Energy Investment Credit Program: Answers to Frequently Asked Questions

On June 1, 2023, the IRS issued a Notice of Proposed Rulemaking (NOPR) regarding the low-income communities bonus energy investment credit program (the LMI Adder) under the Inflation Reduction Act. This document first provides a high-level summary of what the NOPR covers, followed by a more in-depth review of the NOPR in the form of an FAQ.