CESA Blog

New CESA Report: The Case for Replacing Fossil-Fueled Peaker Power Plants with Battery Energy Storage

Fossil-fueled peaker power plants are expensive, polluting and inefficient. They are also disproportionately sited in low-income communities, communities of color, and areas already overburdened by pollution, creating equity, public health and environmental concerns. Now, a new report from the Clean Energy States Alliance (CESA) shows that battery storage can cost-effectively replace aging fossil-fueled peakers in…

Three Questions with Stephanie Watson, Floating Offshore Wind Manager at the Maine Governor’s Energy Office

The Gulf of Maine contains some of the nation’s best offshore wind resources, but its deep ocean and harsh conditions present formidable obstacles to offshore wind development. Maine has embraced the challenge, with Governor Janet Mills signing An Act Regarding the Procurement of Offshore Wind Energy Resources this past summer, authorizing the state to procure…

“Solar for All” Applications Forecast Bipartisan Support for and Monumental Expansion of Low-Income Solar Market

“I have not pulled all-nighters like this since college!” is not something you hear every day from state energy officials. And yet, it reflects the excitement felt across the country in states both red and blue since last summer when the U.S. Environmental Protection Agency (EPA) launched the $7 billion Solar for All competition, a…

Three Questions with Chris Kearns, Acting Commissioner of the Rhode Island Office of Energy Resources

In October 2023, Massachusetts, Connecticut, and Rhode Island signed a memorandum of understanding (MOU) to create a pathway toward the nation’s first multi-state offshore wind power procurement solicitation. The MOU allows developers to submit bids to the three states at once, which could potentially reduce costs for ratepayers, diversify the region’s energy portfolio and expand…

Three Questions with Matt Shields, Researcher at the National Renewable Energy Laboratory

In May 2023, the National Renewable Energy Laboratory (NREL) published a report titled A Supply Chain Road Map for Offshore Wind Energy in the United States. Combined with its sibling report from 2022, titled The Demand for a Domestic Offshore Wind Energy Supply Chain, the two reports looked at the pathways for developing a domestic…

How to Make the Most of the Investment Tax Credit: Applying for Bonus Credits

The Investment Tax Credit and its Bonus Credits are a game changer for improving the economics of solar and solar+storage projects. For most customer-sited projects, at least 30 percent of eligible solar and solar+storage project costs are eligible for either: Direct pay reimbursement (for tax exempt entities) or A tax credit (for entities with tax liability)…

Three Questions with Jonathan Kennedy: An Update on the New Jersey Wind Port

The New Jersey Wind Port, currently under construction, is slated to be the nation’s first purpose-built offshore wind marshalling and manufacturing port, an important milestone for offshore wind development in the US. The port broke ground in 2021, and its first phase is on track for completion in April 2024. Subsequent phases will be completed…

A Case for Regional Collaboration among States in the New Offshore Wind Economy

In 2022, US state governments increased their collective procurements of offshore wind power to over 8,100 MW. While these collective procurement targets have the potential to transform electricity generation in the US, states have so far come to these targets and approached offshore wind development more generally, on an individual basis. To fully realize the…

Helping States Meet the Solar for All Challenge

The federal Inflation Reduction Act (IRA) has created the best ever opportunity to bring the advantages of solar to low-income households and disadvantaged communities. Up to now, residential and community solar installations have been financed and developed in ways that make it easy for households with above-average incomes to participate and benefit, but often leave…

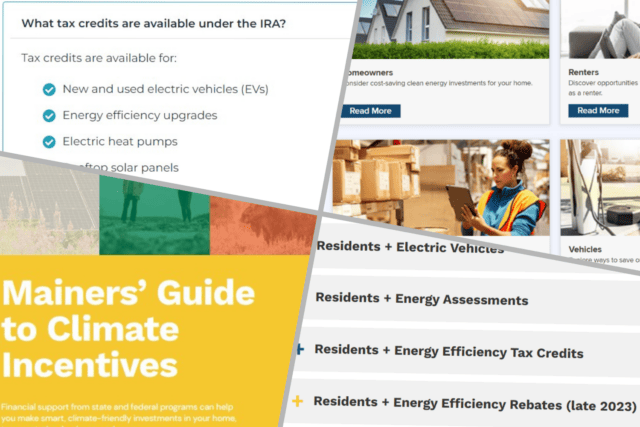

State IRA Websites: A Valuable Tool for Public Education

For the Inflation Reduction Act to be successful, the public needs to know how to apply for, qualify for, and receive the many tax credits and rebates that will be offered. Between rebates from the Home Energy Rebate Programs and tax credits for consumers, businesses, and tax-exempt entities, consumers have the potential to save billions…

Three questions with the California Energy Commission

Clean Energy States Alliance Research Associate Sam Schacht spoke with three senior members of the California Energy Commission (CEC)—International Relations Senior Advisor Alana Sanchez, Chief of Staff for CEC Chair David Hochschild Katerina Robinson, and Director for Siting, Transmission, and Environmental Protection Division Elizabeth Huber—about how California has worked with international and sub-national partners to…

Browse by Project

- IRA & BIL Implementation

- 100% Clean Energy Collaborative

- Building Decarbonization and Clean Heating/Cooling

- Energy Storage Policy for States

- Energy Storage Technology Advancement Partnership

- Interstate Turbine Advisory Council

- Low- and Moderate-Income Clean Energy

- New England Solar Cost-Reduction Partnership

- Offshore Wind

- Renewable Portfolio Standards

- Scaling-Up Solar for Under-Resourced Communities

- Solar with Justice: Connecting States and Communities

- State Energy Strategies Project

- State Leadership in Clean Energy

- Sustainable Solar Education Project