IRA & BIL Implementation Blog

Future of Clean Energy is Brighter as State Summit on IRA/BIL Implementation Concludes

On April 17 and 18, 2024, 37 states, the District of Columbia, and federal government representatives gathered in Washington, DC, at “IRA, BIL, and the Future of Energy: A Summit to Support State Implementation.” The Summit, sponsored by the U.S. Department of Energy’s (US DOE) Office of Policy and co-hosted by the Clean Energy States…

“Solar for All” Applications Forecast Bipartisan Support for and Monumental Expansion of Low-Income Solar Market

“I have not pulled all-nighters like this since college!” is not something you hear every day from state energy officials. And yet, it reflects the excitement felt across the country in states both red and blue since last summer when the U.S. Environmental Protection Agency (EPA) launched the $7 billion Solar for All competition, a…

How to Make the Most of the Investment Tax Credit: Applying for Bonus Credits

The Investment Tax Credit and its Bonus Credits are a game changer for improving the economics of solar and solar+storage projects. For most customer-sited projects, at least 30 percent of eligible solar and solar+storage project costs are eligible for either: Direct pay reimbursement (for tax exempt entities) or A tax credit (for entities with tax liability)…

Helping States Meet the Solar for All Challenge

The federal Inflation Reduction Act (IRA) has created the best ever opportunity to bring the advantages of solar to low-income households and disadvantaged communities. Up to now, residential and community solar installations have been financed and developed in ways that make it easy for households with above-average incomes to participate and benefit, but often leave…

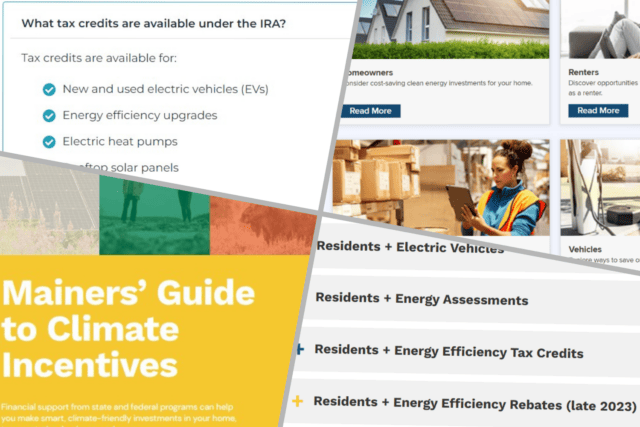

State IRA Websites: A Valuable Tool for Public Education

For the Inflation Reduction Act to be successful, the public needs to know how to apply for, qualify for, and receive the many tax credits and rebates that will be offered. Between rebates from the Home Energy Rebate Programs and tax credits for consumers, businesses, and tax-exempt entities, consumers have the potential to save billions…

EPA’s Climate Pollution Reduction Grant Program: Planning Grant Guidance

EPA recently released full guidance for states to apply for Phase I planning grants, which represent the first tranche of money available through the Climate Pollution Reduction Grant (CPRG) program. This blog post pulls out the most important information that states need to know ahead of the March 31st deadline to inform EPA of their…

EPA’s Climate Pollution Reduction Grant Program: Preliminary Information and Timeline for States

EPA has released some new details and an application and implementation timeline for their $5 billion Climate Pollution Reduction Grant (CPRG) program, which was created under section 60114 of the Inflation Reduction Act (IRA). While the program is designed to be inclusive of municipalities and tribes, the majority of funding for planning grants will be…